Middle & Senior management hiring & succession planning is always a challenge and its made tougher by most firms not having institutionalized mechanisms to identify and treat information asymmetry between internal and external prospects .If you have ever bought a used car- information asymmetry is the difference between what the seller tells you and what you discover 3 months later 😉

If you think the above statement is a bit extreme- take a look at the churn in management and the reasons given by folks in exit interviews that their company did not recognize their potential but gave someone else the “benefit of the doubt”. And if you are looking for a scientific basis- look no further than Nobel prize winning Psychologist- Daniel Kahenman who gave the concept of WYSIATI -“What you see is all there is” which means that we take a decision based on information presented to us – our mind does not compare the depth and quality of information available. The result is that folks who are hired from outside are actually hired on potential but folks who are not promoted from inside are done so on basis of the in-depth information available or sadly the/ biases that form because of knowing them so long. But no one questions the quality of information available to make the comparison.

Too often companies ignore Internal candidates because they know too much about the person. And hire an External person because they know too little about him/her.

A Case Study

Candidate X was a National Sales leader for a large Financial Services Company. He was creative, intelligent and open to new ideas. Most of the senior sales team were groomed by him and liked his personal attention, knowledge sharing , informal banters and his tendency to delegate and challenge. The CEO identified his potential and gave him General Management responsibilities over a region ; X got them results and was soon anchoring 65% of the revenues of the company – not only as sales but also through general management with control over regional HR, Talent Acquisition, Training, Finance and Administration and Facilities. X got a bit of swagger and rubbed some of the entrenched bureaucracy in the corporate team the wrong way. The CEO should have stepped in and given him a 1 on 1 feedback but I guess the results and revenue results overshadowed everything else.

A person in his team got into a serious compliance issue and he tried to protect him and it gave the powers be a reason; And they went after him with a vengeance- and the wind changed to immature, risk taker , arrogant . When the CEO moved on – a panel was set up and a new CEO from outside was identified who fitted the “risk” profile”- and the internal candidate moved on to make another company very very successful.

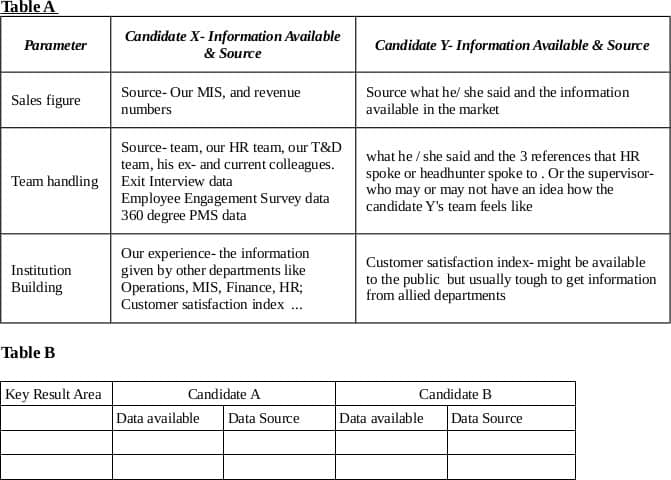

In the case study above- there was no attempt to put the information in a structured manner that will reduce both the data asymmetry as well as the Halo effect . See Table A- below which gives the information in a format which reduces bias and brings out the asymmetry

The only way to rectify this is to make a level playing field in terms of quality of data available for both internal and external candidates

- Information needs to be captured and displayed in a structured manner -Table B is a representative template we use while advising clients

- Weight needs to be given to information source as well

- Get Panel discussions done- they help in reducing the Halo effect

- Invite Outside experts who are immune to internal politics and biases

- When someone in the selection panel starts saying ” my gut instinct says”- hit them with a bat – okay don’t but this is your cue you are not talking to an expert or someone who has anything credible to say

- Do 360 degree discussions, involve – allied departments as well as folks who might report to the role involved.

Pingback: Executive Search at the Intersection of Strategy, Leadership & Culture – AceProHR

Pingback: 5 concepts in statistics every hr manager must know – AceProHR