This was a recorded call at a Call centre

- Sound of the phone ringing & after about 10 rings

- Client picks up and their is a faint “hello”

- Telecaller- Sir this is with reference to our discussion last week, I have been trying to reach you since morning for sending my executive for the companion card you wanted.

- Client- faint reply ‘but”

- Telecaller- Sir you told me last week you will take this card—do you want me to detail you the features again

- Client…another faint “but…

- Telecaller- sir my executive is nearby and can reach you immediately- just need your wife’s id card and signatures

- Client-….but,,,,,,,I am just coming back from the cremation ground – my wife died suddenly…( and trails off- I think the guy is in shock and not kept the phone down)

- Telecaller…..,arrrrr tomorrow then?

A reaction to the above recording is usually best described as – hierarchical ” it was a junior team- member who get influenced by incentives and sales pressure more. But…

- Did the PWC folks who “partnered “ Satyam were innocent fools or just looking the other way as long as they could milk the retainer.

- Or was Kovacevich the CEO of Wells Fargo obsessed with customer service / interest? – NO he likened bank branches as “stores,” and bankers were “salespeople” whose job was to “cross-sell,” which meant getting “customers”—not “clients,” but “customers”—to buy as many products as possible. His slogan “Going for Gr-Eight,” ( i.e. sell at-least 8 products to one customer) resulted in countless fraudulent accounts opened and credit cards made . ( Vanity Fair)

- In 2009, the Swiss bank UBS agreed to pay the U.S. government $780,000,000 to settle charges that it had orchestrated a massive scheme to help wealthy Americans evade U.S. tax laws.The UBS case—the largest tax fraud investigation in history—began with the arrest of a single banker named Bradley Birkenfeld. Birkenfeld was one of several UBS employees who had repeatedly helped clients evade U.S. taxes, and he agreed to cooperate with the US Justice Department in return for being allowed to plead guilty to a single count of conspiracy to defraud the U.S. government. When the judge who heard Birkenfeld’s plea asked him why he had participated in the scheme when he knew he was breaking the law, the 43-year-old banker replied: “I was incentivized to do this business.” (Killing Conscience: The Unintended Behavioral Consequences of ‘Pay For Performance’ Lynn A. Stout Cornell Law School )

The Flawed Economics & Behavioural Science behind variable pay

The homo-economicus model of behaviour dominates economics- i.e.- Human Behavior is directed towards purely by selfish gain and objective assessment of this gain and any incentive which links this gain to company/ shareholder value will align employee behaviour to company goals.

The homo -economicus model has thankfully been challenged- in fact Thaler’s Nobel is a testimony that economics will take a more “humane” approach to people rather than consider them as benefit assessing zombies

Behaviour science ignored intrinsic motivation and explained behaviour in terms of punishment avoidance and biological drives.

This was challenged by decision science pioneers like Simon and Kahenman.

In a now famous case cited by Kahenman in Thinking Fast & Slow – A creche in Israel decides to discourage parents coming late to pick up their wards- by imposing a late fee, the result was more and more people coming late.

Reason till now the parents depended on the good faith of the teachers and were motivated to not break it – but since the creche turned it into a transaction ( fine) – the mental shift was “since we are paying for it – might as well take more time” This is the same reason that paying for blood donation- actually reduces the amount of “clean” donation.

A HBS study showed that the non-commissioned works of 23 artists were rated higher on creativity than the commissioned works by a panel of judges who did not know which painting was commissioned and which the artist did on their own.

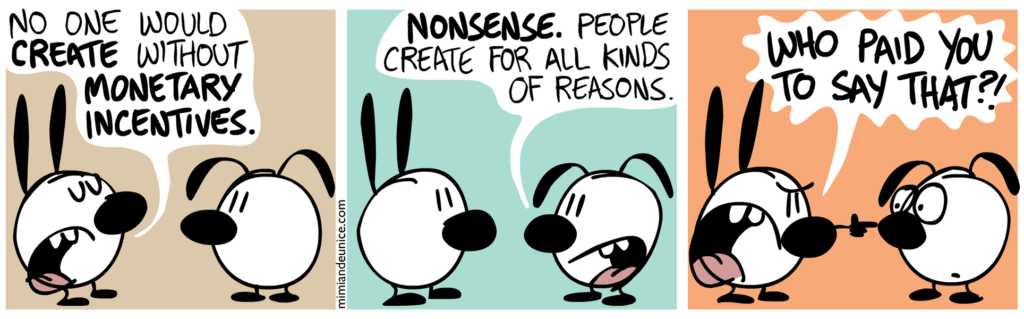

But before you say that is just art and what about “work” – the answer is Linux, Apache, Wikipedia … and many more -each created in the absence of any kind of monetary awards .

Consequences of a variable addiction

Variable pay or conditioning employees for a certain behaviour has the same mental pattern as an addicts puff- the dopamine rush that accompanies “each reward”- results in the addict craving more. The need for the dopamine rush-reduces risk perception and makes people take higher risks to get more of the same kick and this has definite consequences for corporations:-

- Higher percentage of variables results in higher frauds-A good example is the insurance industry where not only the agency model ( completely variable) is mired in unethical behaviour – even the corporate agency and banking insurance model makes for higher fraud- especially because of high first year incentives.

- MLM industry- which encourages cult like behaviour and a few “successes” feed off a 1000 failures !

- Incentives result in Short term focus by investors and top management which snowballs into teams which are either ethically compromised or don’t innovate as their focus is on immediate results

- AND It takes the joy out of work- An experiment with monkeys divided them into 2 groups- one received immediate reward for solving puzzles and the other did not . The first groups motivation fell ( puzzles solved) when the incentives were withdrawn- while the group which was not given incentives- continued to enjoy solving them even without rewards. We are slightly more evolved and maybe more inclined to do something for joy .

Some therapy for the Variable addiction

- Find a purpose- nothing motivates us more than a purpose – a deeper purpose than just money . Whether its making people happy or making clients safer -Purpose has to be non- transactional.

- Remove or reduce variable considerably. A higher fixed will have the following consequences

- Reduce Attrition- people promised a salary above a certain bar- will not have a flight / fight response. This results in a more engaged workforce.

- Increase long term thinking

- Reduce risk taking behaviour and consequently – fraud/ unethical practices

3. Focus on reducing pay disparity between top and bottom- more equitable companies out perform the non equitable ones . As the Wall street Journal stated in 2006 – $100 invested in the 20% of companies with the highest-paid CEOs would have grown to $265 over 10 years. The same amount invested in the companies with the lowest-paid CEOs would have grown to $367.

Omar Farooq

Great teams are not made by chance!

Founder- AceProHR