Banks are screwed. They got hit by a triple whammy

1. Structural Shift

Technology has changed the game completely- Alibaba’s payment platform – Alipay is morphing into an all-in-one banking tool: a savings bank, wire service and investment house. In the US- The banks that pay the most interest on savings are online-only banks (GE Capital, ING Direct, Ally) that can afford to do so only because they don’t have to operate branches. Some India Examples

- PayTm is trying to replicate Alipay

- Peer lending – faircent, lendbox.in

- Investment Platform- Groww.in – is revolutionising how you buy mutual funds

- Micro Finance- https://kaleidofin.com/ helping folks at the bottom of the pyramid save and even invest

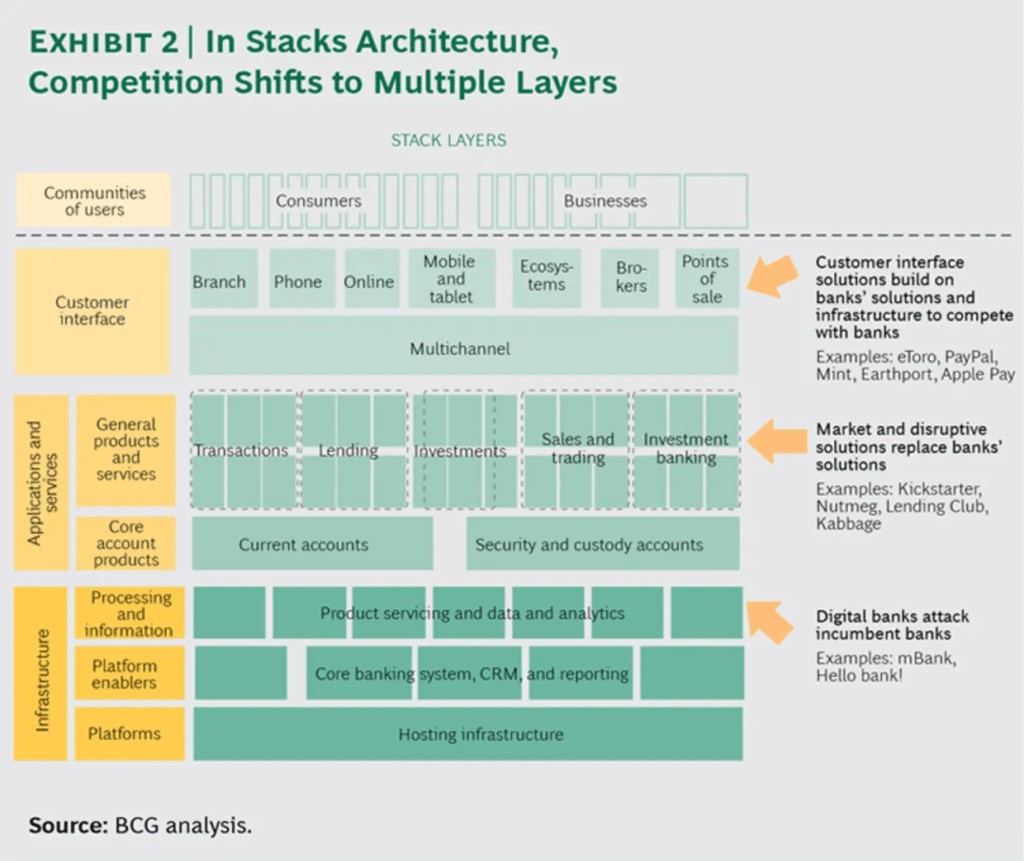

In 2016 BCG released a POV on how vertically integrated banks face a structural shift to stacks as value chains disintegrate and competition shifts to multiple layers

2. Lack of trust

- NPA’s were already at historic highs and with Covid -9 it will get worse

- Yes Bank, ICICI Bank , PMC Bank , PNB- have shown the rot at the top management and left people wondering – who next ?

The Answer- Creative Destruction led by Human Resource

I do think this is the time for HR to come out of its stupor and take the lead in reinventing banking

Automate & Reduce your workforce – if HR does not reduce headcount and play a major role in automation- – IT teams and consultants will do it for them in 1 or 2 years- and then you will not be able to control the fallout and indiscriminate firing .

- Nordea Bank in Sweden plans to cut 50% of its workforce with – with automation and robots taking over from people in everything from asset management to answering calls from retail clients

- Credit risk/ fRecruitment & Employer Branding – Banks have lost their mojo at campuses and also at lateral placement raud risk assessment through Algorithms/ Machine learning is more objective and transparent. I recently met a CEO who wanted to create capacity through – automation + analytics – he told me he needs a CTO, who can help him make his Underwriting/ Credit risk capacity 10X without adding 10X people.

- A lot of fraud risks are curtailed by removing human intervention- especially in retail banking

Recruitment & Employer Branding – Banks have lost their mojo at campuses and also at lateral placement

- Revitalise/ Rethink Campus – Getting day 3 in an IIM might mean you are better off – Day 1 in a SIBM or IIFT- focus on folks who are excited by what you are offering not someone who takes you as a compromise and moons after the next startup or consulting firm. ( If you want more ideas- read Pedigree is overrated )

- Bust your Compensation budgets for IT and Analytics- the talent competition is going to be vicious- if you cannot bust your budgets- you might want to in-source to get better quality.

- Create Pivotal role list- and brand them to get better quality folks . For example – Branch Managers- the quality has fallen because its so “meh” now. The folks in risk and underwriting- its a classic goal keeper role – they get no “credit” and get blamed when the shit hits the fan!

Personalise and Reinvent Branch banking – Branch banking right now is shitty- I use a local HDFC branch for both saving and business banking . The assistant branch manager has been trying to sell me a ULIP. After a couple of polite refusals- I told him – why don’t you offer me a term plan – I might actually buy that and he disappears because the commission on term plans is insignificant compared to ULIP.

- If your branch manager does not know the top 50 local businesses and top 50 account holders on first name basis- find another one

- Service

- Service

- Service

- Sales as a SIN(tm) – Service Identified Needs – please stop pushing stupid products like ULIPS or random calls to folks and offering loans which make no sense for them.

Compensation -Huge variable pay combined with performance management criterion which focus on fee earned are a perfect recipe for fraud & unhealthy risk taking. Banks should increase fixed pay and reduce percentage of variable to get people to think long term and not bonus to bonus.

- In 2009, the Swiss bank UBS agreed to pay the U.S. government $780,000,000 to settle charges that it had orchestrated a massive scheme to help wealthy Americans evade U.S. tax laws.The UBS case—the largest tax fraud investigation in history—began with the arrest of a single banker named Bradley Birkenfeld. When the judge who heard Birkenfeld’s plea asked him why he had participated in the scheme when he knew he was breaking the law, the 43-year-old banker replied: “I was incentivized to do this business.” (Killing Conscience: The Unintended Behavioral Consequences of ‘Pay For Performance’ Lynn A. Stout Cornell Law School )

- Kovacevich the CEO of Wells Fargo obsessed with customer service / interest? – NO he likened bank branches as “stores,” and bankers were “salespeople” whose job was to “cross-sell,” which meant getting “customers”—not “clients,” but “customers”—to buy as many products as possible. His slogan “Going for Gr-Eight,” ( i.e. sell at-least 8 products to one customer) resulted in countless fraudulent accounts opened and credit cards made . ( Vanity Fair)

- Senior Management Payment & Performance Management – “Senior bank managers would be paid not in cash or equity, but in the bank’s long-term bonds, thereby giving them a larger financial stake in the bank’s long-term stability, instead of its long-term stock price. If the bank failed, it would be unable to repay the bonds, and the managers owning bonds would be that much poorer”. – Professor Mark Roe- Harvard Law School

See our Case against variable pay for more options

Specific Culture Changes

I have realised the easiest thing to say is make the culture more employee centric and customer focused- because no one knows what it means but it sounds good . Here are some specific things you can focus on

- Stop hero worship- whether it’s an outperforming branch manager or the CEO – because that is how you end up with Chanda Kochar or Rana Kapur . Focus on how the team achieved the goal , making holy cows is one of Indian banking’s biggest behavioural weak points.

- Power distance– Hofstede’s Power Distance score for India was very high for culture, with a ranking of 77 compared to a world average of 56.5. This Power Distance score for India indicates a high level of inequality of power and wealth within the society. This condition is not necessarily imposed upon the population, but rather accepted by the society as a cultural norm- Remember Chanda Kochar- when the news came out – any one objectively seeing it from outside would have screamed bloody murder- but ICICI top Management- HR & Board- wrote a letter stating they have full faith in her leadership. Has the HR head been sacked?? just wondering

- Stop abusing junior & middle management – Abuse does not mean just calling names – it means Working unnecessary hours and getting calls after 6 pm , Working 6 days , Working in an unhealthy and unproductive physical environment. Bottom line no work life balance is abuse

Great teams are not made by chance ! Ask us how we can assist you

Omar Farooq Founder & CEO – AceProHR (omar@aceprohr.com)