The dark knight- How the talent function can rescue the IT Services industry

The Indian IT industry is at the crossroads – and the options are survival, slow decline , revival & renewal.

I believe the HR function can spearhead the renewal of IT services and lead the industry out of its current rut; And the reason , as so often is – talent holds the key.

The challenges facing Indian IT Services firms

- Productivity

- Product initiatives have been a non -starter

- Consulting has not delivered

- GCC Challenge

- Already missed the bus on AI ?

- Business Environment

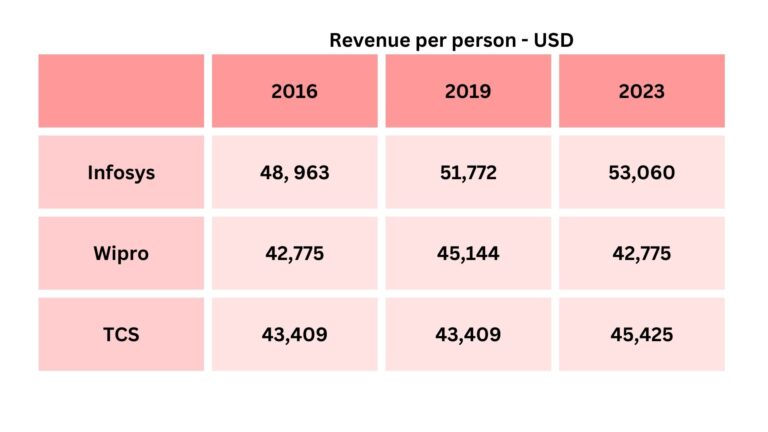

Productivity

The aggregate revenue per employee for Tata Consultancy Services (TCS), Wipro, and HCLTech, with the exception of Infosys and Tech Mahindra, experienced a decline of 3.8% to 11 percent on a five-year compound annual growth rate (CAGR) basis in FY23. This decline was driven by the increase in hiring across these companies in response to the Covid pandemic-driven demand, surpassing net revenue growth, which remained relatively slow paced due to lower margins in digital deals.

Here is data that you need to put to “leaders” who ask you to work 70 hour weeks . Because this is what leadership failure looks like-

P,.S.- Accenture per person revenue in 2023 was- 88555. USD

Product initiatives have been a non starter

Apart from Finacle-by Infosys ; Can you name 1 successful product created by the Indian IT service giants ?

Why firms which claim to outsource “Product engineering” for the world’s best and have access to not only some of the best IT talent but also domain experts have not been able to develop world beating products has been a dichotomy that has been unanswered for 2 decades now.

Consulting has not delivered

Consulting teams were supposed to be the holy grail for productivity and integrate with core IT services to deliver an experience that would challenge the best on Digital Transformation. But the productivity gains of consulting team have been marginal at best

I can think of just one reason that has resulted in Consulting and Productisation being non starters

Both require- high level technical and domain expertise combined with a gestation period to develop the practice or products. But when you are used to a 20-25% return on IT services through labour arbitrage, the drive required to over invest in people and time to develop consulting and products is sadly missing and often questioned by leaders and shareholders.

Already missed the bus on AI ?

Accenture Plc, the world's largest technology services firm, reported securing $900 million in generative artificial intelligence (GenAI) project bookings for the three months through May. This brings the total to approximately $2 billion in GenAI deals for the first nine months of the current fiscal year, underscoring its robust growth in a rapidly evolving technological landscape.- Live Mint- 21 June 2024

There is no Indian Services company even in the rear view mirror ?

Business Environment

- Macroeconomic Uncertainty: Persistent uncertainty in key markets for IT companies has resulted in pauses or deferrals of non-critical projects and a slowdown in discretionary IT spending.

- Softening Demand: Softening demand in key sectors like banking, financial services, and insurance, retail, technology, and communication is affecting the sector.

- Revenue Growth to Slow Down: The Indian IT services sector’s revenue growth is expected to slow down to 3% in the current fiscal year, compared to the previous year’s growth of 9.2%

- Operating Profit Margin (OPM) Pressure: Operating profitability is expected to moderate 150-175 bps in fiscal 2023 to 22-22.5% due to higher employee costs

- Artificial Intelligence & Automation will make many outsourced roles obsolete – particularly at the low end of the value chain

GCC Challenge

Service firms not only lose out on probable revenue when a firm sets up a GCC rather than work through them- but they take away some of the best talent from the service firms – and the reason is simple

- Higher Compensation

- Better Quality work

- Infrastructure, work conditions & even employee engagement.

there are close to 1600 GCC’s in India with about 1.6 million people and will rise to 1900 in 2025-26.

Diagnosis- the Why?

In a service organisation the short term focus is Delivery of a project within Scope, budget and time . The long term goal is optimising operational efficiency and capabilities that come with scale- including a matrix of industry and functional specific knowledge

In a Product organisaiton the primary goal is design, development and launch of the product in the market and ongoing returns over the product lifecycle which can last years. The long term objective is to monetise service/support , different permutation-and when possible adaption to different industries and markets/geographies.

….. Reconciling the short term objectives of product and service organisations is tough, and in the long term it becomes practically impossible. The following is a blueprint of what can be done

“Senior managers at most traditional companies have been left gasping for air at the breadth and rapidity of change Hierarchy has to be replaced by networks, bureaucratic systems transformed into flexible processes, and control-based management roles must evolve into relationships featuring empowerment and coaching. In observing companies going through such change, we have come to the conclusion that as difficult as the strategic challenges may be, they are acted on faster than the organizational transformation needed to sustain them. And however hard it is to change the organization, it is even harder to change the orientation and mind-set of its senior managers. Hence today’s managers are trying to implement third-generation strategies through second-generation organizations with first-generation management.”

Seems familiar? Seems right ?

p.s.- Christopher A. Bartlett and Sumantra Ghoshal wrote this in their seminal article – Building Competitive Advantage Through People in 2002 !!

The Dark Knight Phase

The dark knight phase ?- because the talent function will have to lead a campaign of creative destruction! But this is a better position to be in than “being branded as the folks who just do diwali rangoli”

It has to start with creating different structures for Product and Service organisations and follow it up with – right sizing, trim a bloated middle management, Destroy silos, and consolidate and develop a leadership cadre made of technocrats, not just account managers or people managers.

But whatever you save as compensation budget should be relocated right back to the survivors as increases in fixed salary – not doing that is making sure that once you have trimmed the good ones leave in droves.

But why different structures- because everything in talent policies will be different for the 2 groups- they cannot be managed in the same structure, Ideally there should be 2 CEO’s. not the 2 CEO structure Wipro tried and failed but 2 CEO’s – one for Business as Usual Services business and the other for Products .

The Talent function should be also be separate for both the organisations as it requires different focus areas & capabilities

- Employer Branding

- Recruitment & Selection

- Compensation structure

- Performance management and Succession planning

- Bonus- how to take the GCC challenge head on

Employer Branding

Service

The IT services companies have lost their mojo – not just with Grade I MBA and Engineering Schools but with Grade II as well

They need to make it sexy for young people to consider them as a career options- need to create a EVP centred on career growth, international exposure and development

For a primer on Employer Branding read our blog

Employer Branding for Product teams

The focus is going to be creating talent communities – whether its around product engineering , product management or focus on centres of excellence.

This is a experienced audience branding push needs to be more nuanced – focus on engineering leadership , product brand & product impact on the industry & customers.

Recruitment & Selection

Service organisation

- hiring for a pyramid organisation with a broad base

- Focus on entry hiring and second priority is middle management

- First line people managers are the cultural lever of a service organisation- Need to work obsessively to get this right.

- Train to hire options

- Selection funnel is tuned for bulk hiring with predictable quality- hence tests and interviews focus on “rejection”- whether its hard or technical skills

Product Organisation

- Hiring for specialised teams and a broad middle management pyramid

- Focus on team level selection- with multiple selection tests including peer level discussions

- Selection focuses on technical acumen, team work, comfort with horizontal career movement

- For a primer on how to choose the right assessment tool- and the difference between rejection / selection tools- do read our our blog- 5 factors to Evaluate an Assessment Instrument

Compensation

When I was in college one of the favourite compensation stories of Infosys how the Driver to the founder became a millionaire ! Right now – let me give some benchmarks

- 25-40 % less Compensation at Big 5 service companies compared to some of the best GCC

- 40-70% less compensation at Big 5 service firms compared to some of Product organisations. And for some skill sets- it can go upto 100% +

- 10-35% less compensation at Big 5 compared to the Big4 consulting firms .

Fixed salaries at the IT services firm – need drastic changes if they were to catch up with the real world . With Consumer / especially food inflation running at 6-10% we have a junior management which is actually making less compared to 3 /5 years back.

Let us talk Long term Incentives- while the ESOP programmes have no traction because the stock price is static- there should be some way to create long term incentives/ wealth creation

- Match ESOP bought by employees at 0 cost at 3 year retention anniversary, another gave Phantom Stocks equivalent to 20% of fixed compensation every year apart from Variable.

- RSU ( I do not know the Indian law on this) – but companies like Amazon captive in India do this extremely well, for leadership levels they an be 1:1 of the fixed compensation.

- Aggressive Retention Bonuses at 3 & 5 years can be a great addition

- And if you cannot think anything innovative- give paid sabbaticals !

Performance Management

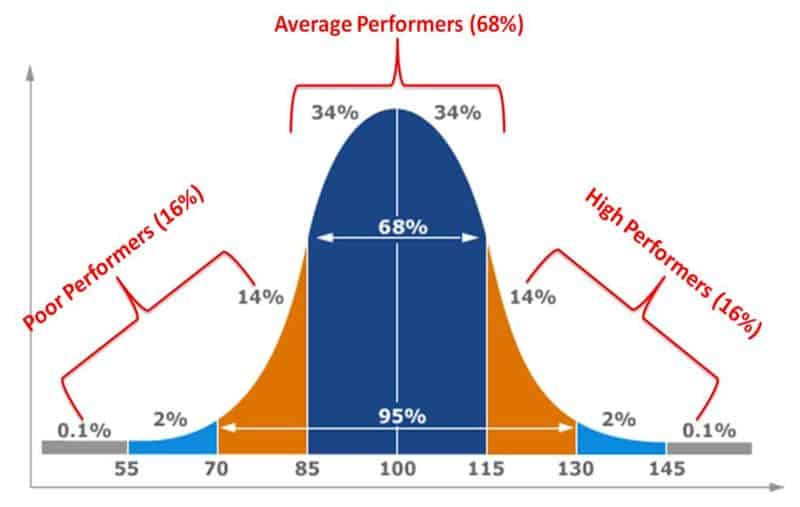

Service Industry

Service Industry

Most of the roles in the IT services industry would come under the normal curve – for analysis . And that should drive performance management, and compensation. Compensation Ranges will not be too wide and Good and average differential should be made up through training and development .

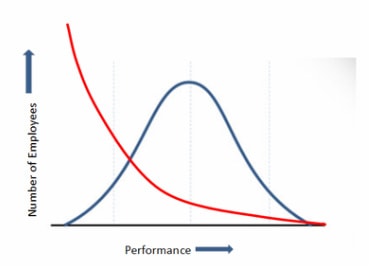

Product Firms

Organisation where success depends on Engineering chops and innovation usually tend to become ruled by the power curve – and hence wide range in compensation, within same teams . The difference is average and exceptional is huge- and usually unsurmountable – so hire better

and innovation usually tend to become ruled by the power curve – and hence wide range in compensation, within same teams . The difference is average and exceptional is huge- and usually unsurmountable – so hire better

Do read our blog-winner takes all- the talent economy ruled by power law

Taking the GCC Challenge

While the honeymoon lasts and everyone paints a rosy picture – here is the reality of GCC’s

- Yes they are great… well majority of them!Right now a PR blitz is hiding the terrible state of quite a few talent hubs

- You will find quite a few defeating the purpose of having a talent hub- focusing only on labour arbitrage.

- A lot of them suffer from what I call the “GCC football”- basically passed between power centres at the HQ – and end up having no consistent vision

- Not scaling up- Scaling up can be a problem for even the best GCC’s- especially for hot skills like- Product Engineering, Data Science, ML & AI- unless they let go of the compensation benchmarks sold to them at the time of pitching of business / GCC model

- It is easy to identify the above – just ask your talent team to find the GCC with abnormal people turnover- this is a natural target list for Service firms. to hunt for business

- I have seen quite a few GCC’s give up and go back to service firms – re-badged or acquired …. and the reasons are usually the following

- Targeted cost saves were not realised

- The International leadership team are inexperienced in offshoring

- Indian management / leadership hiring was poor

References

- 3 of India’s top 5 IT firms saw revenue per employee decline in last five years- moneycontrol

- TCS, Infosys, Wipro see decline in revenue per employee in FY16

- Companies Look to Pay Tech Vendors Based on Business Outcomes, Not Usage- WSJ July 5

- Accenture secures GenAI orders worth $2 billion in first nine months of FY24- Mint June 21

Global Capability Centres: Transforming India’s job market– Economic Times

- Building Competitive Advantage Through People- Christopher A. Bartlett and Sumantra Ghoshal January 15, 2002. MIT Sloan Management Review